Home affordability is a major factor that impacts your house buying power. Are you planning to buy a home so that you won’t have to pay rent anymore? Or do you want to buy a house bigger than your current one? If that is so, then you should stop searching apartments for rent in Pompano Beach and start looking for houses. However, doing so will bring in more challenges for you. At present, home affordability is a concern, and many factors are impacting your ability to buy a house.

Factors affecting Home Affordability

Inflation is a major reason that people are unable to buy a house. House prices have increased in this era of inflation, reducing the Home Affordability for people. There are three major factors that affect the Home Affordability today. These factors include mortgage rates, house prices, and income crises.

Mortgage rates

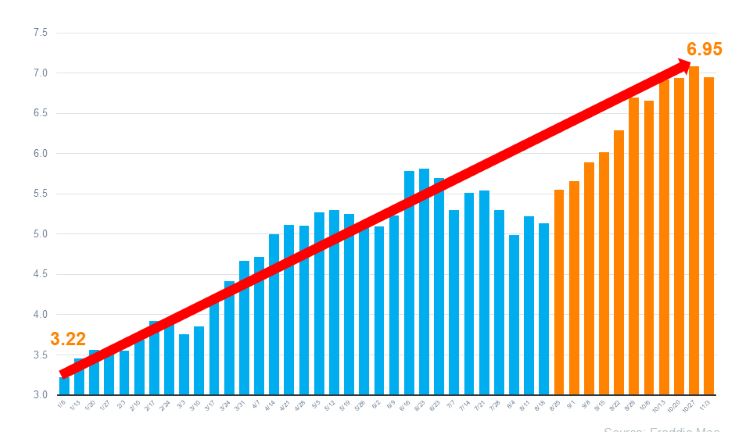

Mortgage rates increase and decrease with time. In the last 50 years, mortgage rates have been going up and down. The Corona pandemic reduced mortgage rates. Due to low mortgage rates, a lot of people tend to buy houses. When the demand for houses increased, it resulted in an increase in mortgage rates.

Effect of mortgage rates on house affordability

During the last year, mortgage rates have increased dramatically and abruptly. Mortgage rates have increased to 6 – 7 % this year.

- Mortgage rates increase the overall house prices.

- Because of high mortgage rates, house purchases are reduced.

- House prices reduce because of high mortgage rates

- When house prices are reduced, more people start buying houses.

- Because of this, house prices have increased again.

When someone mortgages a house, they have to pay a specific amount of their income to pay the mortgage. The higher the mortgage rate, the more amount they have to put aside every month to pay their loans. But the incomes have not increased as much as the mortgage rates have increased. It affects the ability of people to get loans to buy a house. So, the increased mortgage rates have been a major factor that affects the affordability of homes for people.

House prices

When the mortgage rates are higher, house buyers tend to stop buying houses. As a result, the prices of houses are lowered. When the house prices decrease, it compels potential buyers to buy houses. When there is an increase in house demand, the house prices tend to increase. Over the past few years, there has been an increase in house prices. When we observe the history of an increase in house prices, we can observe that house prices in the 1950s were much lower than today’s house prices. The gap in prices is so huge that we have to wonder what caused this increase in house prices.

Reasons for the increase in house prices

There are many reasons for the increase in house prices. Following are some of the major reasons for the increase in house prices.

Mortgage rates

One of the major reasons for the increase in house prices is lower mortgage rates. During the pandemic, mortgage rates were reduced, and overall house prices were lowered. This made many potential buyers purchase houses. When the housing demand increased, that ultimately increased the house prices.

Construction costs

Another reason is construction costs. Since the world has seen an increase in inflation, the prices of construction materials have also increased. When construction material is imported from another country, the custom tax also causes the prices to increase. As a result, house prices have increased too.

Land prices

Land prices are also one of the main reasons for the increase in house prices. With the increasing population of the world, the demand for land is also increasing. This demand results in an increase in land prices and ultimately house prices are also increased. An increase in inflation also increased house prices. Inflation-induced increase in mortgage rates affects the buyer’s ability to buy houses. The house demands also result in increased housing prices.

Income crises

Income crises are another factor that affects housing affordability. For a person with an average salary, it might take 10 to 15 years, or even more, to save for the down payment of a house. Your wage determines if you can afford a house or not. You do not only have to cover your living expenses but also put aside a fraction of your income to buy a house.

Why is income important when buying a house?

- If you want to mortgage a house, even then, your salary plays a huge role.

- The lenders demand you to have a steady income source so that they know that you will be able to pay your mortgage.

- High wages increase the chances of securely landing a mortgage deal.

There has been a rise in income in recent years. Also, the salaries of employees are increased annually. But the increase is 2 – 3 %. The wages are not increased as much as the house prices are increased. This reduces the affordability of house prices.

Conclusion

When you are planning to buy a house, you will have to consider the above-mentioned factors and how these factors will affect your affordability to buy a house. it will be in your best interest to contact real estate experts if you are buying a house for the first time. When buying a house, making a good house offer helps you get a good deal. Know how to make a house offer in 6 steps to secure a good housing deal.

Read More: What is buy-to-let property and factors to consider before investing?